Balancing Charge On Super Deduction . — the balancing charge calculation will depend on the timing of the disposal. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. The relevant factor is reduced. The amount of the balancing charge will be up to 130% of the cost.

from synergi-finance.co.uk

The amount of the balancing charge will be up to 130% of the cost. — the balancing charge calculation will depend on the timing of the disposal. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. The relevant factor is reduced.

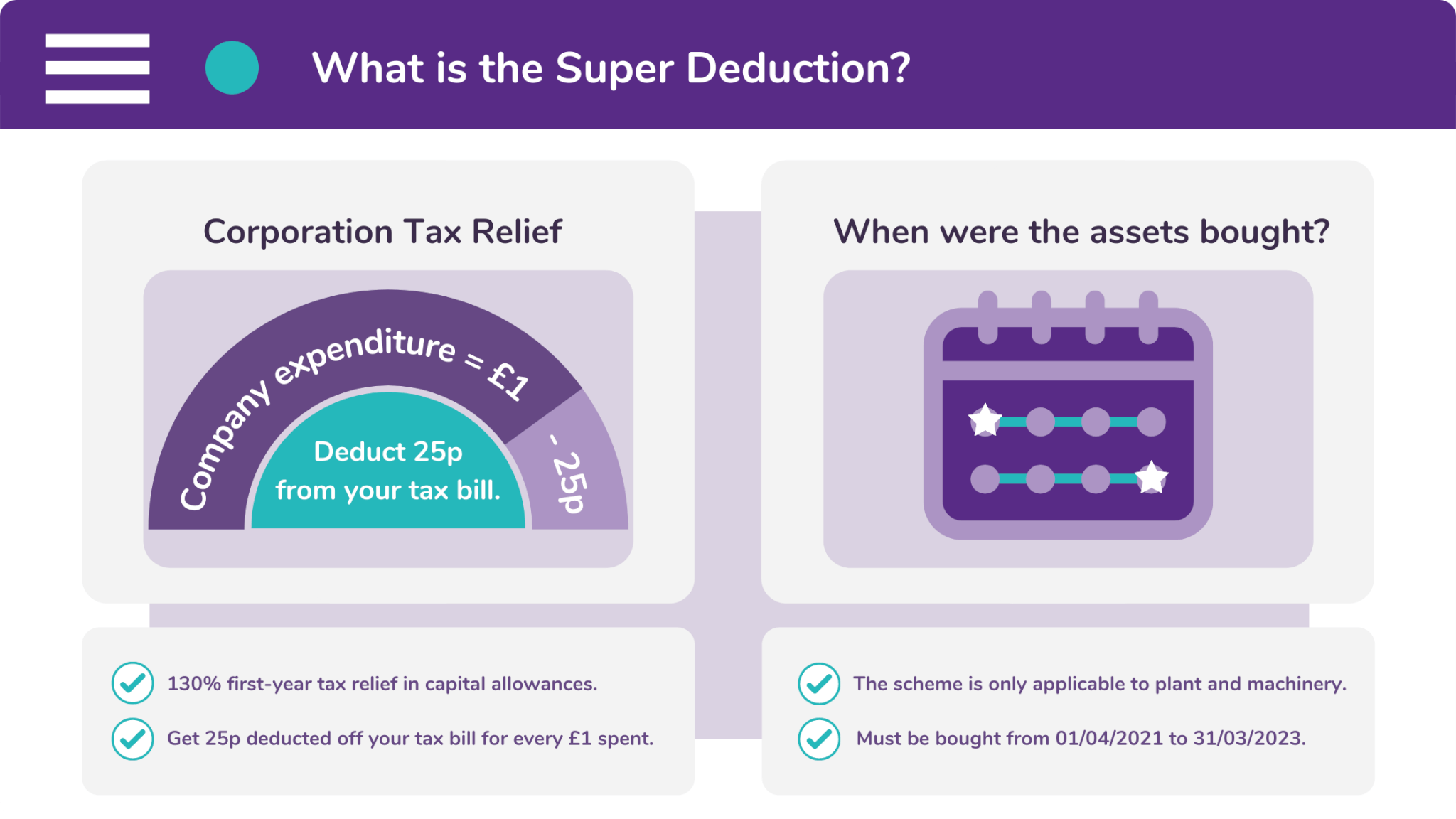

What is the Super Deduction? Features & Benefits

Balancing Charge On Super Deduction if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. The amount of the balancing charge will be up to 130% of the cost. — the balancing charge calculation will depend on the timing of the disposal. The relevant factor is reduced. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:.

From mungfali.com

Charge Balance Equation Balancing Charge On Super Deduction — the balancing charge calculation will depend on the timing of the disposal. The relevant factor is reduced. The amount of the balancing charge will be up to 130% of the cost. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. Balancing Charge On Super Deduction.

From www.powerscreen.com

UK Tax 'Super Deduction' Comes Into Force Balancing Charge On Super Deduction — the balancing charge calculation will depend on the timing of the disposal. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. The relevant factor is reduced. The amount of the balancing charge will be up to 130% of the cost. Balancing Charge On Super Deduction.

From mcl.accountants

130 Superdeduction Capital Allowance on Leased Assets Balancing Charge On Super Deduction The relevant factor is reduced. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. — the balancing charge calculation will depend on the timing of the disposal. The amount of the balancing charge will be up to 130% of the cost. Balancing Charge On Super Deduction.

From kb.taxcalc.com

SuperDeduction and FYA capital allowances available between 1 April Balancing Charge On Super Deduction if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. The relevant factor is reduced. — the balancing charge calculation will depend on the timing of the disposal. The amount of the balancing charge will be up to 130% of the cost. Balancing Charge On Super Deduction.

From www.slideserve.com

PPT Lesson PowerPoint Presentation, free download ID3761913 Balancing Charge On Super Deduction if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. The amount of the balancing charge will be up to 130% of the cost. The relevant factor is reduced. — the balancing charge calculation will depend on the timing of the disposal. Balancing Charge On Super Deduction.

From www.atkinsonsca.co.uk

‘Superdeduction’ on capital allowances Atkinsons Chartered Accountants Balancing Charge On Super Deduction if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. The amount of the balancing charge will be up to 130% of the cost. — the balancing charge calculation will depend on the timing of the disposal. The relevant factor is reduced. Balancing Charge On Super Deduction.

From cartisian.com

2021 Super Deduction Tax Allowance Explained Cartisian Technical Balancing Charge On Super Deduction The relevant factor is reduced. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. — the balancing charge calculation will depend on the timing of the disposal. The amount of the balancing charge will be up to 130% of the cost. Balancing Charge On Super Deduction.

From www.youtube.com

Super Deduction and Corporation Tax YouTube Balancing Charge On Super Deduction — the balancing charge calculation will depend on the timing of the disposal. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. The relevant factor is reduced. The amount of the balancing charge will be up to 130% of the cost. Balancing Charge On Super Deduction.

From www.vansalesuk.co.uk

Save Money on Vans with the Super Deduction Tax Break Van Sales UK Balancing Charge On Super Deduction if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. The amount of the balancing charge will be up to 130% of the cost. The relevant factor is reduced. — the balancing charge calculation will depend on the timing of the disposal. Balancing Charge On Super Deduction.

From www.vrogue.co

Balancing Chemical Equations Overview Examples Expii vrogue.co Balancing Charge On Super Deduction The amount of the balancing charge will be up to 130% of the cost. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. — the balancing charge calculation will depend on the timing of the disposal. The relevant factor is reduced. Balancing Charge On Super Deduction.

From hhba.co.uk

Super Deduction Haywards Heath Business Association Balancing Charge On Super Deduction The relevant factor is reduced. The amount of the balancing charge will be up to 130% of the cost. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. — the balancing charge calculation will depend on the timing of the disposal. Balancing Charge On Super Deduction.

From accotax.co.uk

WHAT is a Balancing Charge? Accotax Balancing Charge On Super Deduction if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. The relevant factor is reduced. — the balancing charge calculation will depend on the timing of the disposal. The amount of the balancing charge will be up to 130% of the cost. Balancing Charge On Super Deduction.

From taxscouts.com

Balancing Charge TaxScouts Taxopedia Balancing Charge On Super Deduction The relevant factor is reduced. — the balancing charge calculation will depend on the timing of the disposal. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. The amount of the balancing charge will be up to 130% of the cost. Balancing Charge On Super Deduction.

From www.shipleystax.com

Superdeduction for tax the basics you need to know Shipleys Tax Balancing Charge On Super Deduction if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. — the balancing charge calculation will depend on the timing of the disposal. The amount of the balancing charge will be up to 130% of the cost. The relevant factor is reduced. Balancing Charge On Super Deduction.

From exouhvmie.blob.core.windows.net

Balancing Charge Def at Tracy Lewis blog Balancing Charge On Super Deduction — the balancing charge calculation will depend on the timing of the disposal. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. The relevant factor is reduced. The amount of the balancing charge will be up to 130% of the cost. Balancing Charge On Super Deduction.

From www.mtsplant.co.uk

What does the Super Deduction on Plant mean for you? Tax Break Explained Balancing Charge On Super Deduction The amount of the balancing charge will be up to 130% of the cost. The relevant factor is reduced. — the balancing charge calculation will depend on the timing of the disposal. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. Balancing Charge On Super Deduction.

From xispactre.blogspot.com

How To Calculate Balancing Charge And Balancing Allowance Malaysia Balancing Charge On Super Deduction — the balancing charge calculation will depend on the timing of the disposal. The relevant factor is reduced. The amount of the balancing charge will be up to 130% of the cost. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. Balancing Charge On Super Deduction.

From alexander.co.uk

Super deduction How it works and how to maximise its use Balancing Charge On Super Deduction The amount of the balancing charge will be up to 130% of the cost. The relevant factor is reduced. — the balancing charge calculation will depend on the timing of the disposal. if the disposal takes place before 1 april 2023, a special balancing charge calculation is needed for assets on which the super deduction was previously claimed:. Balancing Charge On Super Deduction.